kentucky inheritance tax calculator

Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner. It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes Click here to check state-specific laws.

Kentucky Estate Tax Everything You Need To Know Smartasset

Some estates will be exempted from state inheritance tax because they are too small.

. Most of the time the closer the relationship the greater the exemption and the smaller the tax rate. Kentucky Inheritance and Estate Tax Laws can be found in the Kentucky Revised Statutes under Chapters. Inheritance tax calculator how it works.

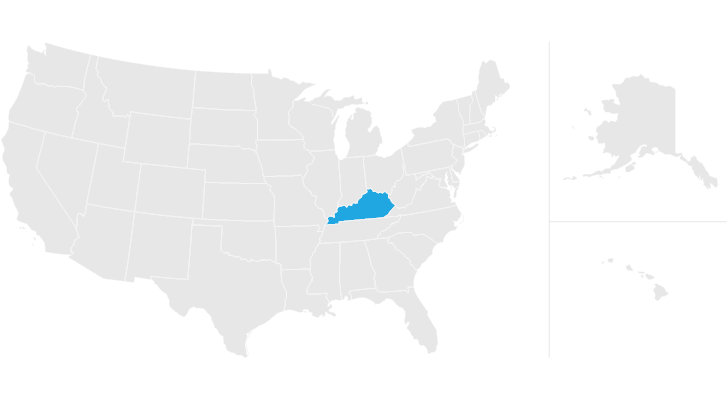

Beneficiaries of a will in Kentucky may be subject to the Kentucky inheritance taxThe inheritance tax is different from an estate tax-which was repealed in Kentucky in 2002-because it is paid by the beneficiaries rather than the estateWhether a tax comes out of an estate or a legacy however most people making wills would prefer to avoid taxes on inheritance if at. In Kentucky the tax rates vary from 0 to 16 depending on i the relationship of the deceased and the person receiving the gift and ii the amount of the gift. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000.

While there is no estate tax in Kentucky there is an inheritance tax. The Class C group can end up paying tax rates anywhere from 6 to 16. 300 Definitions for KRS 140310 to 140360.

But this calculator can help you estimate what potential inheritance tax bill your heirs might potentially have to pay. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. However Class A beneficiaries which consist of the decedents closest relatives such as the Son in this example are completely exempted from the tax.

Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Mortgage Calculator Rent vs Buy. 290 Refund of tax when debts are proved after deduction of tax.

Class B beneficiaries pay a tax rate that can vary from 4 to 16. It does have an inheritance tax however. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

The tax has seen several significant changes through the years. It is one of 38 states in the country that does not levy a tax on estates. Inheritance tax calculator spreadsheet.

The Kentucky inheritance tax is a tax on a beneficiarys right to receive property from a deceased person. This is still below the national average. The factors that have an impact on the Kentucky tax rate include the relationship of the beneficiary.

The estate tax was enacted in 1936. The six states with an inheritance tax are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The inheritance tax is levied on assets and money that have already been passed on to the heirs of the person who died.

Gifts made within three years of death will also be taxed. Capital gains are taxed as regular income in Kentucky. That means they are subject to the full income tax at a rate of 5.

There is no estate tax in Kentucky. The good news is that there are lots of ways to cut down your bill which weve explained in full in our guides to inheritance tax. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent.

320 Taxation of land converted from agricultural use. The Kentucky inheritance tax was adopted in 1906 making it the second oldest General Fund tax. Kentucky inheritance taxes Kentucky has an inheritance tax ranging from 4 to 16 that varies based on the beneficiarys relation to the deceased.

Class A beneficiaries pay no taxes on their inheritances. Inheritance and Estate Taxes. Kentucky Capital Gains Tax.

All other individuals related or unrelated will pay between 8 and 12 of their inheritance. The most recent change occurred in 1995 when a total exemption. The kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a kentucky estate.

Kentucky inheritance tax is levied on three classes of estate beneficiaries at the decedents death. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Real estate transferred to a son-in-law or daughter-in-law may be valued at its agricultural value.

Class A Class B and Class C. Kentucky has an inheritance tax ranging from 4 to 16 that varies based on. For Class C members only 500 is exempt from Kentuckys inheritance tax.

Each state will have rules for properly valuing an estate. Inheritance tax reduced rate calculator you may qualify to pay inheritance tax at a reduced rate of 36 if you leave at least 10 of your net estate to charity. Kentuckys inheritance tax applies to everyone except spouses parents children grandchildren and siblings.

The rate of tax and the exemptions allowed depend on the legal relationship of. The Kentucky inheritance tax is a tax on the right to receive property upon the death of another person. The highest marginal rate of inheritance tax is 16.

The closer the relationship the smaller the tax liability. Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. In Iowa for example an estate valued at 25000 or less is not assessed inheritance taxes.

The amount of the inheritance tax depends on the relationship of the beneficiary to the deceased person and the value of the property. Calculate if the estate is too small. Kentucky Inheritance Tax In Kentucky real and personal property will be valued at its fair cash value on the decedents date of death.

330 Land presumed assessed at agricultural value -- Procedure when not so assessed. In iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. Beneficiaries are required to pay the inheritance tax.

Inheritance Estate Tax. Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand. Class a beneficiaries pay no taxes on their inheritances.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Inheritance tax might also be due from the people who receive gifts. Anyone who doesnt fall into Class A or Class Bfor example cousins friends and corporationsis part of Class C.

A Class B inheritor who inherited 150000 would pay 8960 plus 14 of the amount over 100000 or 22960. 310 Assessment of agricultural or horticultural land for inheritance tax purposes. For certain close relatives.

There are three classes of beneficiaries in.

Why Some Americans Should Still Wait To File Their 2020 Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kentucky Estate Tax Everything You Need To Know Smartasset

Calculating Inheritance Tax Laws Com

Accountant Its All About The Records Sepia By Paul Ward Accounting Records Coding

Twitter Debt Relief Programs Best Home Loans Kentucky

House Hunting Checklist House Hunting Checklist House Hunting Buying First Home